Generating sample trust letters/notices for international addresses

You can generate and send sample trust letters/notices to international addresses holders, in addition to the primary customer.

To generate sample trust letters/notices for international addresses:

-

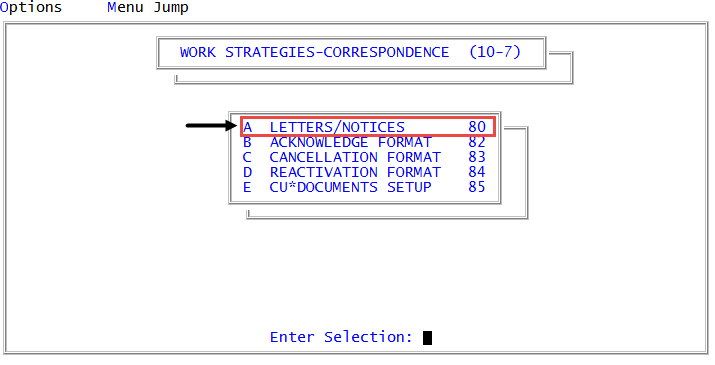

In the Master menu, navigate to

Management Strategy > Correspondence > Letters/Notices (menu 10.7.80).

Management Strategy > Correspondence > Letters/Notices (menu 10.7.80). - In the Letters/Notices Setup window, select Generate Samples, and press Enter or click Ok.

- In the Request/Generate Sample Letters window, select Trust Letters, and press Enter or click Ok.

- In the Enter Account Number window, do one of the following, and press Enter or click Ok.

- To send one trust letters/notices, type the account number.

- To send multiple trust letters/notices, type X followed by the account number. For example, type X2967.

- If a notice is currently in effect for the account, in the Request Or Cancel Letters To Individual Accounts screen, at the Notice Series X in effect. Cancel? prompt, do one of the following; otherwise, proceed to Step 6.

- To cancel the notice series, click Yes.

- To not cancel the notice series, click No.

- In the Letter/Document/Letter Set (AA,IA,?a) window, type IA.

- In the Enter Letter / Document / Letter Set (?a) window, do one of the following, and press Enter or click Ok.

- If you know the name of the letter/notice, type it.

- To see a list of letters/notices, documents, or letter/notice sets, type ?.

- In the Valid Letter by Category window, select a letter/notice, and press Enter or click Ok. The letter/notice is requested.

- In the Alternate Name (/AP,/EMP,/EMP2,?) window, do one of the following, and press Enter or click Ok.

- To send correspondence to an individual or business, type the name.

- To use the alternate payer name, type /AP.

- To use the employer name, type /EMP.

- To use the second employer name, type /EMP2.

- To see a list of options, type ?.

- In the Help window, select one of the options, and press Enter or click Ok.

- In the Alternate name2 (/AP,/EMP,/EMP2,?) window, do one of the following, and press Enter or click Ok.

- Verify the name is correct.

Type a new name.

If you type a new alternate name or any new information in the following fields, the Fiscal file is not updated with the information. The information you type is only used for the correspondence.

-

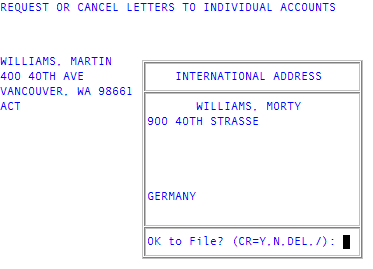

In the International Address box, do the following, and press Enter.

- In the first row, verify the address or type a new one.

- In subsequent rows, type additional address information.

-

In the last row, type the country.

The country is required.

- At the OK to File? (CR=Y, N, DEL, /) prompt, do one of the following:

- To save your changes, press Enter or type Y, and press Enter. Proceed to Step 18.

- To discard your changes, type N, and press Enter.

- To delete and then reenter the international address, type DEL, and press Enter. Repeat Steps 10-11.

- In the Alternate Name2 (/AP,/EMP,/EMP2,?) window, type an alternate name2 name, and press Enter or click Ok.

-

In the Alternate Address window, type an alternate address, and press Enter or click Ok.

This field and the following fields are required.

- In the Alternate Address2 window, type an address, and press Enter or click Ok.

- In the Alternate City window, type an alternate city, and press Enter or click Ok.

- In the Alternate St window, type an alternate state, and press Enter or click Ok.

- In the Alternate Zip window, type an alternate zip code, and press Enter or click Ok.

- If the account status inhibits letters/notices from being sent, the Account status X inhibits notices and letters. Override? prompt displays. Do one of the following:

To override the status, click Yes.

The letter/notice is requested.

To not override the status, click No.

The letter/notice is not requested.