Managing post-dated checks

When a person agrees to a post-dated check plan, they send the agency a number of signed and dated checks with the amounts filled in. The agency deposits each check on its deposit date. Just before each check is deposited, a letter is automatically sent to the account notifying the payer that the check is being deposited. Management sets up the letter series covering the different circumstances and payment intervals for various postdated check plans ahead of time. For more information, see Menu 10.7.80 - Letters/Notices.

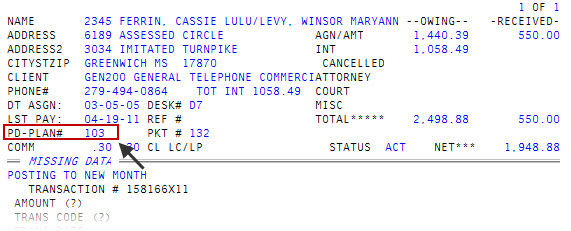

You can set up an account on a post-dated check plan or a payment plan, but not both at once. When an account is set up on a post-dated check plan, the plan number appears in the place of a payment plan number. In the Posting screen, the PPLAN# (payment plan) field becomes the PD-PLAN# (post-dated check plan) field, as shown in the following example:

You cannot purge, delete, or transfer an account if it is on a post-dated check plan. You can review the plan at any time.

It may become necessary to add more checks to an existing plan. At the time you add checks to an existing post-dated check plan, the system writes a note to the account record showing that more checks have been added to the plan. The notes look similar to this:

1) 040310 09:05AM PD CHECKS 75.00 3 OSTS:ACT |RJ

2) 061510 02:15PM PD CHECKS 150.00 6 |RJ

For example, line 1 shows the original total ($75.00) and number of checks (3). On June 15, 2010, the account sent three more checks to the agency totaling $75.00. When these were entered, the system added the new dollar amount and number of checks to the existing amount. Note that line 2 reflects the additional payments: total dollars (150.00) and total checks (6). To find the dollar amount or number of checks that were added, subtract the first note entry from the second.

Fifteen days after all the post-dated checks have been posted, the plan is removed from the post-dated check file and the plan number is removed from the account.

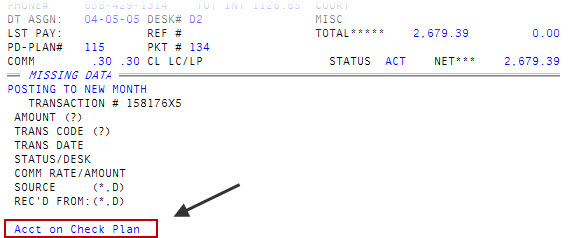

After setting up the post-dated check plan, each time you post a transaction a message displays at the bottom of the Posting screen telling you that this account is on a check plan.

Finding bank routing numbers and other information on checks

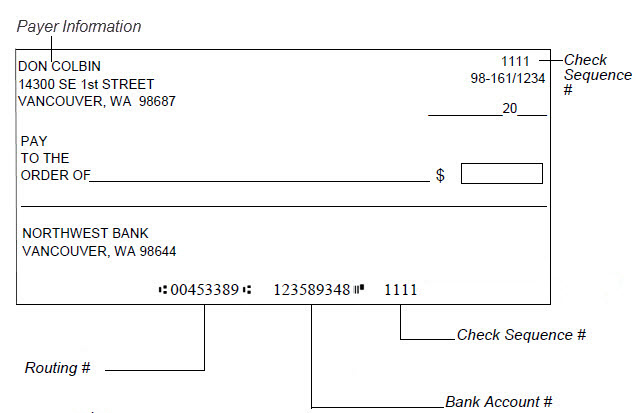

Entering checks in The Collector System requires you to find specific information on the check–such as the routing number, account number, and check number– and enter it into the system.

The routing number is normally the first set of numbers located at the bottom of the check and is nine digits long (or eight digits if the check is from Canada). The account number is the number assigned by the bank that normally displays on the check as the second set of number. The following is an example of a typical check used for a payment:

|

Check Item |

Description |

|

Payer Information |

The payer's name and address information. |

|

Check Sequence Number |

The number assigned to the check by the bank. This information is displayed in the upper right-hand corner of the check. |

|

Routing Number |

A nine-digit number (or eight-digit number if the check is from Canada) that identifies the bank to draw the funds from. |

|

Bank Account Number |

A seven- to nine-digit number assigned by the bank to identify a bank account. This number follows the routing number. |