Charging transaction fees

A transaction fee is an extra charge that your agency adds to a payment amount for the convenience of using a certain payment method, such as an immediate check or a debit card. In The Collector System, you can add a transaction fee to immediate checks, bank cards, recurring bank cards, and future transactions.

The transaction fee amount is determined by the state in which the payer resides.

The payer is not always the customer.

If you create a payment for a payer that resides in a state where you can charge a transaction fee, The Collector System automatically prompts you to either accept or decline the fee. You cannot negotiate transaction fees, and you cannot change them, even if the state fees change. You can only charge a transaction fee if a payer agrees to it.

For example, if the transaction fee for Texas is $2 on July 1st, but is raised to $3 on September 1st, you cannot change the fee from past postings from $2 to $3. You can only apply the new $3 transaction fee (for payers residing in Texas) to new postings starting September 1st. Though the system allows you to decline a transaction fee (meaning the fee is not added to the account), check with your manager regarding your agency's policy on adding additional fees to payments. To change an existing future transactions fee, you need to delete that transaction and then re-enter it with the new accepted fee.

The decision to add transaction fees only applies to the payments taking place in a single phone call. For payment arrangements made in subsequent phone calls, you do not have to automatically apply transaction fees; although you can decide to add them when prompted.

For example, a payer calls to set up future transactions for an account that has a balance owing of $1,000. You create five future transactions of $100. If the payer resides in a state that allows you to charge a $2 transaction fee and the payer accepts it, you can charge the $2 fee to each of the five future transactions. Then the same payer calls a few hours later to set up more future transactions to pay off the rest of the account. When you create more future transactions, you may decide that you do not want to charge the $2 transaction fee. As a result, the future transactions from this second phone call do not have a fee, but the future transactions from the first phone call still retain the $2 fee.

If the payer's state has a fee associated with it and you have set up Fiscal fields for the fee amount and the date the fee was accepted by the payer, then The Collector System automatically updates the Fiscal record with the date and the fee amount the payer agreed to. For information about setting up transaction fees, see The UltimatePayments Setup Guide for The Collector System Guide.

Your agency can configure The Collector System to calculate transaction fee amounts differently. The Collector System can calculate transaction fees in two ways: flat and percentage. A flat fee is a specific dollar amount that applies to any payment, regardless of the payment amount. A percentage fee calculates the transaction fee based on the payment amount (not the account balance), so the larger the payment, the larger the transaction fee. Your agency can use one or both of these ways to calculate transaction fees. If your agency uses both, The Collector System applies the lesser of the two amounts.

Your agency can also configure a maximum flat fee and percentage amount as well as a suggested fee. If you have the option to change the fee, The Collector System charges the maximum flat fee and/or percentage amount.

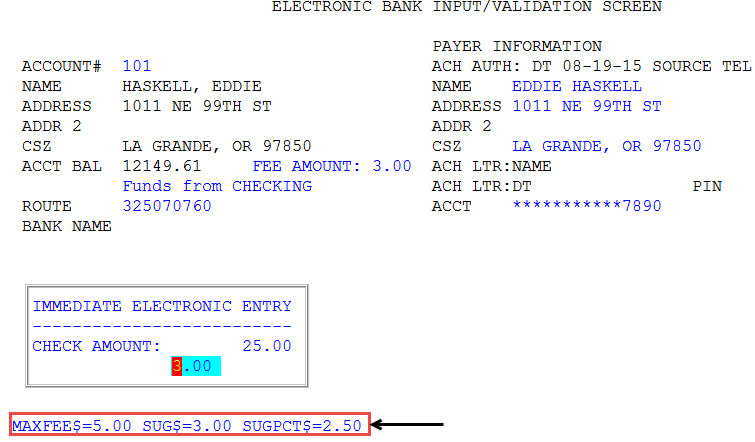

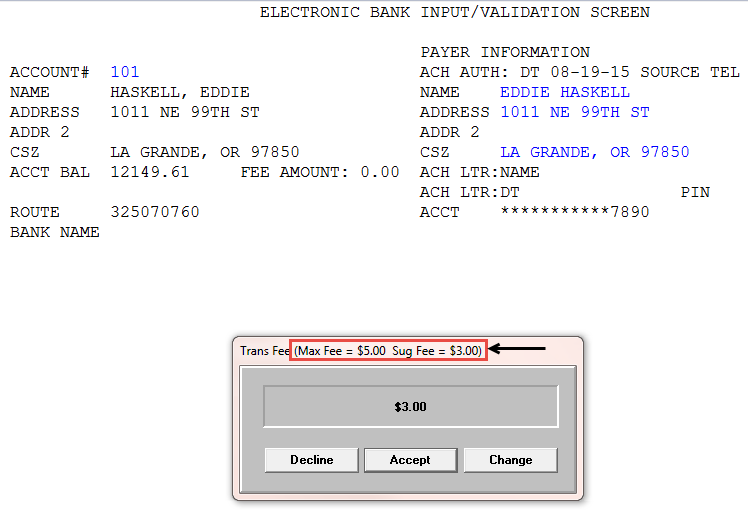

Example

In the following example at a fictitious agency, Lake Assets, collectors can charge the suggested transaction fee of $3. They can also decline to charge the customer, or they can change the amount. The maximum amount the collector can charge displays in the window header. In this case, Lake Assets collectors can only charge a maximum of $5.

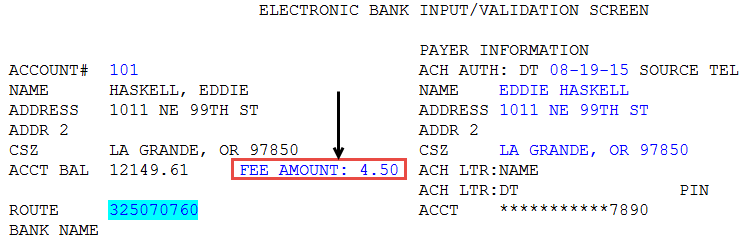

The collector for this payment, Jane Smith, changes the fee amount to $4.50. The new fee amount displays in the Fee Amount field in the Electronic Bank Input/Validation screen, as shown below:

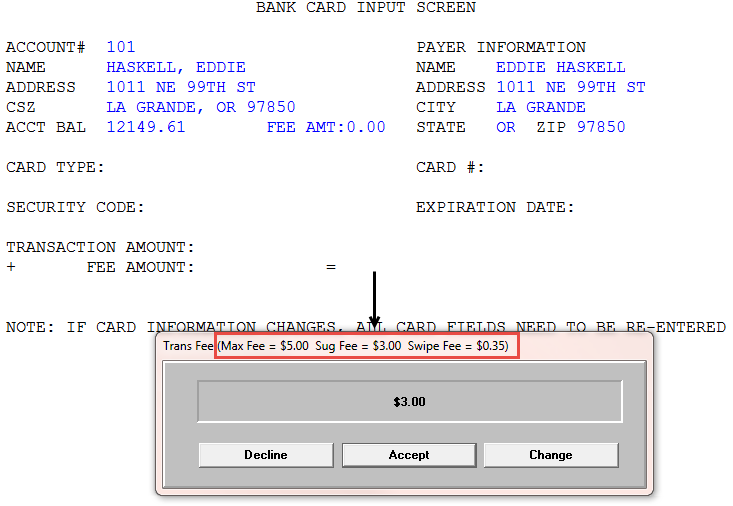

When a customer uses a bank card as a form of payment, your agency will likely charge a swipe fee. A swipe fee is a fee paid by your agency to card-issuing banks or credit card companies for processing bank card transactions. The swipe fee only applies to bank card payments. If set up by your agency, The Collector System always charges a swipe fee, even if you decline the fee.

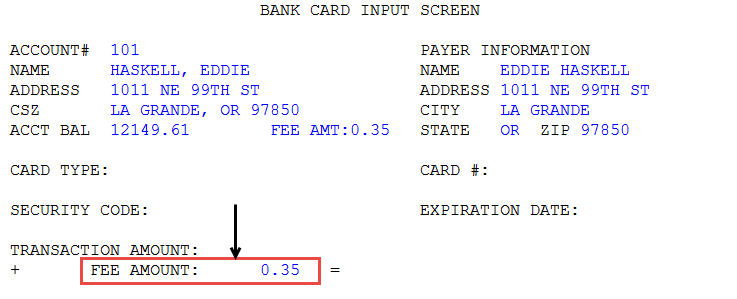

In the following example at Lake Assets, the header in the Trans Fee window displays the maximum and suggested fee amount as well as a $0.35 swipe fee. The Lake Assets collector declines the fee, but because The Collector System always charges a swipe fee if it is configured by the agency, the Bank Card Input screen displays $.35 in the Fee Amount field, as shown below:

As mentioned earlier, if set up by your agency, you may also select to charge a transaction fee based on a percentage of the payment. In the following example of an immediate ACH payment, the Lake Assets collector can enter an amount up to $5. The collector can enter a flat dollar amount, such as $4.50, or by percent. You can enter a percent using decimal or fraction format. To enter a percentage, you precede the number with the percent sign (%). For example, to enter a 5% fee, you enter %.05. Without the percent sign, the fee would be five cents (.05), When entering a fraction, you do not enter the percentage sign. For example, 2/47 not %2/47.