Processing ACH payments

Although this menu option is available from menu 4.20, the ability to run it there is based on if a user has access this feature in Menu 9.

If you are using BillingTree or UltimatePayments as your payment processor, then The Collector System sends the transactions to the processor who then transmits ACH transactions once a day at 5:00 p.m. EST to the Windows PC Service. If you do not use UltimatePayments, you will need to send the batch file manually.

Make sure you process ACH payments before 5:00 PM EST; otherwise, they will not be processed until the next day. If you are not using BillingTree or UltimatePayments, you have to manually send your files to your selected ACH provider. Make sure that you have a procedure in place so you do not miss any transactions (for example, weekends, holidays, and so on) and that you account for all error messages.

Before you perform your next batch process, make sure to archive all the reports generated for the preceding batch process. Also, depending on when you process your payments, you may have to overlap dates to make sure all payments are sent. Be sure your date range picks up any transactions not processed earlier. For example, the authorized date may have been missing.

To process ACH payments:

-

From the Master menu, do one of the following:

-

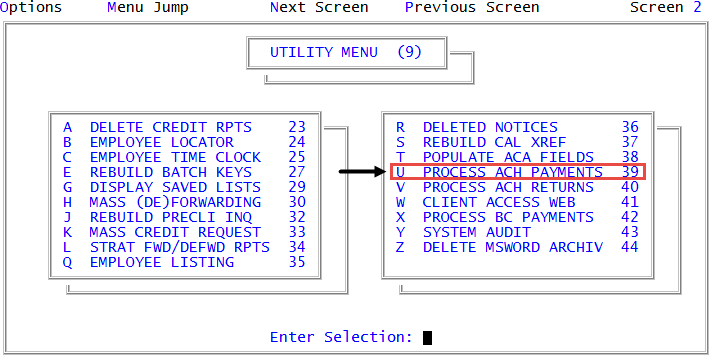

Navigate to

Utility > Process ACH Payments (menu 9.39).

Utility > Process ACH Payments (menu 9.39). - Navigate to Trust Activity > Plan Trans Report (menu 4.20).

- In the Plan Transactions Reports window, select Process ACH Payments, and press Enter or click Ok.

-

- In the ACH report selection window, select Process ACH Checks, and press Enter or click Ok.

-

In the ACH Check Report window, do one of the following to determine which payments are selected, and press Enter or click Ok.

Process today's checks

Process today's checks

Select To be Deposited Today.

Select checks for a range of dates

Select checks for a range of dates

- Select Range of Dates.

- In the Enter Beginning Date window, type the date to begin selecting checks, and press Enter or click Ok.

- In the Entering Ending Date window, type the date to stop selecting checks, and press Enter.

- The default date is today's date. To use this date, press Enter or click Ok.

Process all unprocessed checks

Process all unprocessed checks

Select All Unprocessed checks.

- In the Sort Options window, select a sort option to determine how the payments display on the ACH Checks report, and press Enter or click Ok.

- At the Select your output destination prompt, do one of the following to select your output destination for the reports, and press Enter or click Ok:

- To view the reports on your screen, click View.

- To email the reports, click Email.

- To send the reports to your assigned printer, click Print.

- To exit this process, click Cancel.

-

At the Click yes to generate the batch file which includes the ACH transactions prompt, to continue, click Yes.

If you are using BillingTree or UltimatePayments as your payment processor, the batch file is sent automatically. If you are not using BillingTree or UltimatePayments, manually send the batch file to your payment processor.

When you process ACH payments, these reports automatically display:

Depending on your settings, reports may display behind each other:

- ACH Checks report - Includes all ACH payments ready for processing.

- ACH Checks Sent To PC report - Includes the ACH payments that were processed. The payments that resulted in error do not display on this report.

- ACH Errors report - Includes the ACH payments that were not processed due to errors.

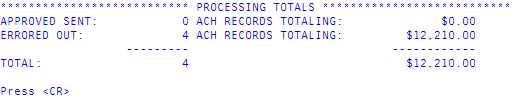

After the batch file is created, the Processing Totals window displays. This screen shows the total payments that were sent, how many received errors, and the total dollar amount to be deposited.

- Press Enter to return to the Utility menu.

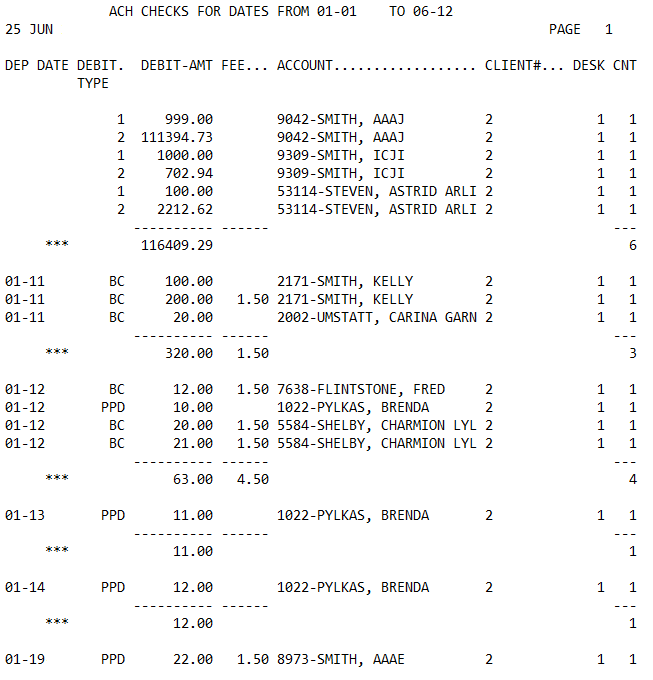

The following is an example of the ACH Checks reports:

The following table describes the columns of the report:

|

Column |

Description |

|

Dep Date |

The date the ACH payment was deposited. |

|

Debit Type |

The payment method used for the transaction:

|

|

Debit-Amt |

The amount deposited for the ACH payment. |

|

Fee |

The amount of the fee charged to the customer for the convenience of using ACH as a payment method. |

|

Account |

The identification number and name for the account. |

|

Client# |

The number your agency uses to identify the client. |

|

Desk |

The desk of the collector who processed the ACH payment. |

|

Cnt |

The number of ACH payments for the desk. |