Managing status codes for canceling accounts

Before canceling an account in The Collector System, you need to create one or more status codes to indicate that an account is canceled. There are two parts to this process.

First, you need to create the status code. Depending on your business processes, you may need to create multiple status codes for use in describing why an account was canceled. The reason why your agency or a client cancels an account will likely be different.

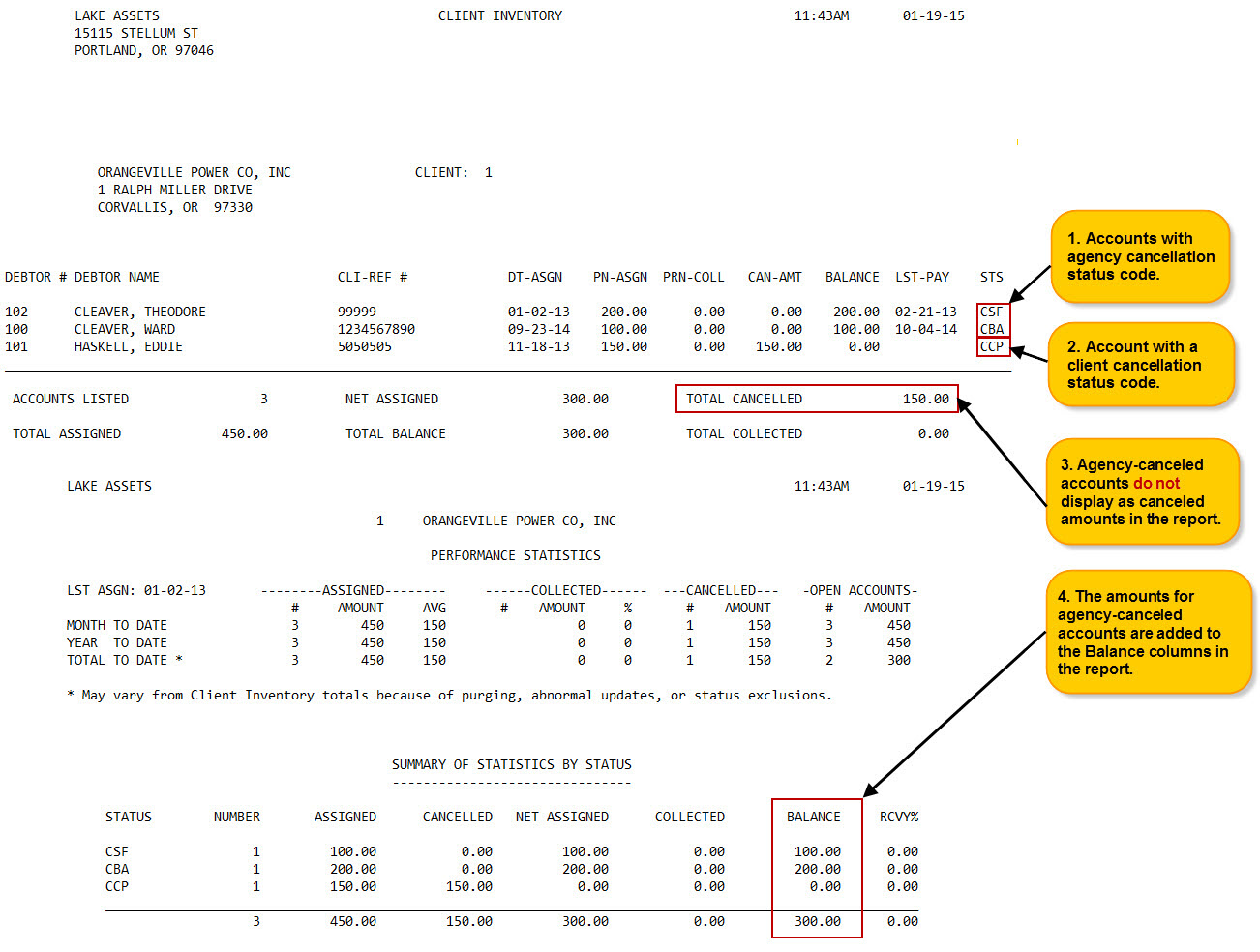

For example, a fictitious agency, Lake Assets, creates two status codes to use when they cancel an account: CBA, for when the agency cancels the account because the customer refuses to pay, and CSF, for when the skip-trace process has failed to find the customer after numerous attempts. Lake Assets also creates status code CCP to use when a client cancels the placements of accounts with them.

After you create the status codes, the next step is to designate them as either agency or client cancellation status codes. The agency or client designation is important because it affects how The Collector System reports the cancellations to the client.

For example, in the Client Inventory report, The Collector System includes accounts canceled by both the agency and the client. Notice, however, that the agency cancellations are not included in the cancellation total columns, as seen below:

By default, The Collector System only includes client-canceled accounts in the canceled totals, while it includes agency-canceled accounts in the balance totals.

The Collector System does this because it assumes you do not want to report agency-canceled accounts to clients. To report agency-canceled accounts to the client, you can change the default settings in the report. For more information, see Configuring the Client Inventory Report.

Other reports are affected by this behavior as well, including the Cancellation report and the Client Statistics report.