Working with notice series

A notice series is an optional feature that allows you to group multiple letters and schedule them to be sent to accounts in a pre-determined sequence at specific intervals. This feature is useful because it not only automates the process of sending multiple notices over an account's collections lifecycle, but it also helps lower your letter costs by allowing you to combine packeted accounts on one notice.

For example, a fictitious company, Lake Assets, has three types of notices they send to accounts during their general collections workflow. Instead of trying to schedule the right letters to go out at the right time, Lake Assets sets up a notice series for all of their trust accounts. The default notice series for Lake Assets includes Notices #1, #2, and #3. They configure the series so that the system generates Notice #1 (NTC1) when Lake Assets adds accounts to The Collector System. The system generates Notice #2 (NTC2) 10 days after placement. Finally, the system generates Notice #3 (NTC3) 20 days after Notice #2 was sent.

In the preceding example, The Collector System automatically generates a letter for each sequence—regardless if the customer has made a payment. You can, however, configure the notice series so that The Collector System automatically generates a different notice based on the customer's payment status. This is referred to as a payment strategy.

When you enter Y in the Use Payment Strategy field, The Collector System first checks to see if and what type of payment you received for the account. Then it refers to the No-Pmt, Partial, and PIF columns for each notice sequence to see what letters it needs to generate for each payment type. You have several options when determining what notices to send for each sequence. You can:

- Send the notice specified in the sequence

- Specify another notice to send

- Stop the notice series

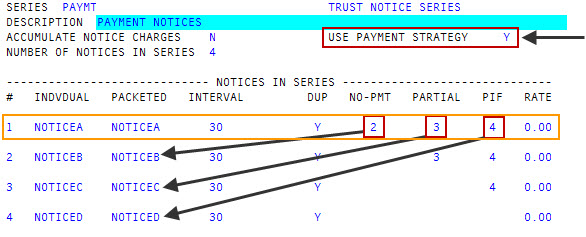

In this example, Lake Assets has set up a notice series for payments. The notice series uses a payment strategy because there is a Y in the Use Payment Strategy field. When The Collector System processes notice sequence #1, it evaluates the account to see if the agency has received a payment. If not, then the system generates the notice in sequence #2 (Notice B). If a customer has made payment on the account, The Collector System determines if the payment was a full or partial payment. For a partial payment, the system generates the notice in sequence #3 (Notice C). For payments that pay the account in full, The Collector System generates the notice from sequence #4 (Notice D).

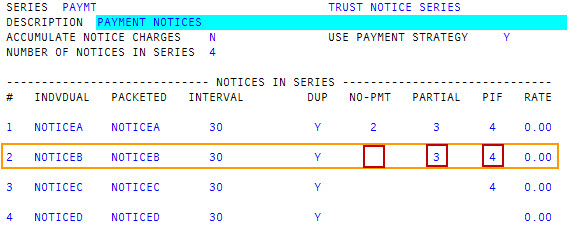

After 30 days pass, The Collector System processes notice sequence #2. Notice that the No-Pmt column is blank for this sequence. This means that the customers who have not sent in a payment during the 30-day interval after Notice A was sent will receive Notice B. Customers that have sent in a partial payment will receive Notice C, and customers who have paid their accounts in full will receive Notice D.

The Collector System continues to evaluate accounts and send letters for each sequence in the series until the series is complete. You can also stop a notice series at anytime by entering an X in any of the No-Pmt, Partial, or PIF fields.

When a new account is added to a packet after the notice series starts, you can configure The Collector System to handle the new account in one of three ways. It can:

- Delete the existing notice series and start the series over with the new first notice.

- Include the new account when generating the remaining notices in the series.

- Start a new series for the new account and continue the existing series.

When using notice series, you need to create at least three default notice series types: a standard notice series that applies to most of the accounts in your general collections workflow, one for precollect accounts, one for accounts on payment plans, and one for post-dated checks. We recommend naming your default notice series, as follows:

|

Default Series Name |

Type of Series |

|---|---|

|

LETTER |

Standard Notice |

|

PRECOLLECT |

Precollect Notice |

|

PPLAN |

Payment Plan |

|

PDCHECK |

Post-Dated Check Notice |

Along with using default notice series, you can also create a custom notice series and apply it to a specific client's accounts. The process of setting up a custom notice series is the same as the default series, but you must enter the notice series name in field 304 - Series Name of the Client Control record. For more information, see Creating or changing the Client Control Record.

If you use the default notice series, you leave field 304 - Series Names(s) blank. When setting up a notice series for accounts on payment plans, you can set an amount or percentage threshold that determines when the system sends a past due notice. For example, if the customer owes a $100 payment, but they send in $90, it may not be cost-effective for you to send a past due notice when the customer is only $10 short. The system evaluates both the percentage and amount fields and uses the lower of the two amounts as the threshold payment amount. As long as the threshold amount is met, The Collector System does not generate a past due notice.