Requesting and receiving customer authorization for future (post-dated) ACH payments

Before your agency can withdraw funds for any future (post-dated) ACH payments, federal and state laws require that you present the terms to the customer as to how and when the payments will be debited from their bank account. By law, you can do this two ways: verbal or written.

The Collector System supports both ways of presenting the terms of the post-dated payment plan and receiving customer authorization; your agency's business processes dictate which one you use. Your agency may allow you to chose to obtain permission verbally or in writing. If this is the case, The Collector System may prompt you to select how you presented the terms to the customer and how you received authorization. For more information, see Step 3 of Making immediate ACH payments.

If you present the payment terms and receive authorization from the customer verbally, you will likely do this over the phone, in which case, you need to do the following:

- Have a phone recording system in place so that your agency can demonstrate that you presented the terms correctly to a customer should your agency be audited.

- Verify that the customer making the payments is the person who is responsible for the account.

- Clearly explain the terms of the future (post-dated) ACH payments. This includes the amount and frequency of each payment, the number of payments the customer needs to make, and/or how long the future payments will last.

- If the customer agrees with the terms, record a statement from them that they authorize your agency to debit the payment amount from their bank account over the duration of the future (post-dated) ACH payment schedule.

- If you use this method, The Collector System automatically enters the current date as the date you received authorization.

Your agency may require that you get permission from the customer in writing instead of verbally. If this is the case, you need to do the following:

- Send a letter to the customer that clearly explains the terms of the future (post-dated) ACH payments and request permission to debit the customer's bank account to process the payments. The letter may generate automatically, depending on how your agency has set up this process in The Collector System.

- The letter may instruct the customer to do one of the following:

- Sign the letter to approve the terms and authorize the withdrawal for the scheduled payments, and then return it to your agency by mail, fax, or a signed PDF document.

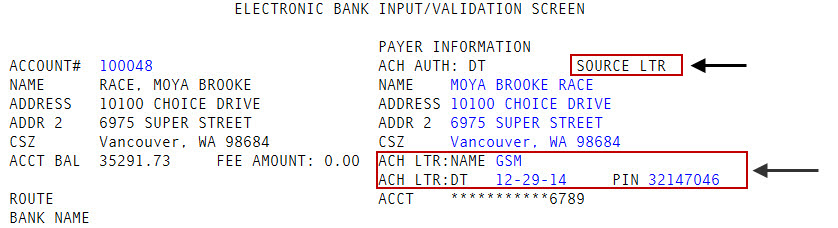

Call your agency to verbally approve the terms and authorize the withdrawal for the scheduled payments. You need to verify that the customer is the responsible party (such as with a social security number) and that the PIN number located on the letter matches the one that displays in the PIN field in the Electronic Bank Input/Validation Screen by having the customer read it to you. This screen also displays the name of the letter and the date it was generated.

- Enter the date your agency received the signed letter from the customer or received a phone call from the customer verifying the letter and authorizing the withdrawal.

The Collector System will not process any future (post-dated) ACH payments until you record the authorization date. For more information, see Recording customer ACH authorization.